Xero’s highly rated accounting app enables you to create and send invoices, monitor cash flow, and reconcile bank transactions directly from your phone. Each month, Xero sends you a link to your subscription invoice with easy ways to pay for your accounting software. You can pay it using Visa or Mastercard debit or credit cards, or by direct debit. The payment date depends on when you signed up to a pricing plan.

Stay productive with the Xero Accounting app

However, the best option and price point will depend on the specific capabilities and features you are looking for. An accountant or bookkeeper can be useful set of hands to help with the accounting heavy lifting. Invite your advisor to work with you on the online accounts anywhere, anytime. Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs. When you use Taxfyle, you’re guaranteed an affordable, licensed Professional. Sync data from your business systems into Google Sheets or Excel with Coefficient and set it on a refresh schedule.

See cash flow at a glance

Xero’s practice software and data work seamlessly together to create an integrated accounting practice management solution. Wave is a solid choice for small businesses looking for free accounting software. Our partners cannot pay us to guarantee favorable reviews of their products or services. Easily create and send invoices and automate invoice reminders for a quicker, hassle free payment. Given that there are several invoicing software on the market, it’s worth putting in some time to research your options before choosing one for your business.

Xero accounting software review

Use the demo company to try things out, or enter your own business details and data to try it out for real. Anything you enter will be retained when you transfer from a free trial to a subscription. Solutions like QuickBooks Online and Zoho Books offer basic accounting features that are designed to help small businesses manage their businesses effectively. It’s handy to be able to sit in a waiting room and still reconcile clients accounts. It’s also very helpful to be able to generate invoices and access important files on my phone. As a Xero Advisor, my clients contact me with questions and I’ve never had to contact support about the App.

Accounting software that helps small businesses using the cloud

Unlike QuickBooks Desktop, Xero also has the mobility and modern UI of cloud-based software. Xero’s simple invoicing tool (Figure A) makes it easy to upload your logo and choose from several branding themes, but I’d love to see more extensive customization options. Xero does offer an invoice template to help get you started, and you can choose to create and save your own templates.

Once customers receive the invoice, they can pay you directly from it by clicking the “pay now” button and using a credit card, debit card or direct debit. You can also accept payments from popular services such as Stripe and GoCardless. We appreciate that Xero includes time tracking in all its plans (see the screenshot below from our demo). This contrasts with many alternatives, such as QuickBooks, that offer time tracking only on more expensive plans or as an add-on. Users are required to download the free Xero Projects app, which they can use to record time and costs and create invoices and reports.

Other affordable, easy-to-use accounting software such as QuickBooks Online and Freshbooks have limits on the amount of users they support or charge extra for additional users. Xero supports unlimited users, which is great for businesses that have multiple team members who need to access their accounting information. Due to its scalability and cost-effectiveness, Xero is a great choice for growing businesses.

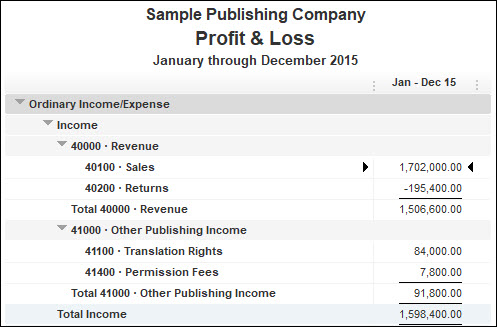

You can request a callback, however, by providing your phone number. Xero’s reporting features allow you to compare your budgets easily against actuals and provide you with an accurate understanding of your business at any given time. You can also create several budgets, including regional budgets, in Xero. You can add data directly from these budgets to your P&L statements.

- Still, despite the price ruling out the software for some small businesses, Xero has a lot to offer for medium and large businesses or those in need of multiple users.

- Xero processes payment through a payment gateway like Stripe, GoCardless and others.

- However, if you’re a business that has a lot of employees that need access to the software, Xero offers unlimited users on all plans—you’ll only find that feature on the more expensive Sage plan.

- Security is a priority for Xero, as we know it is for you, so it’s also important you also take steps to safeguard your data.

We went through all the steps of setting up and using the software for the first time. We also conducted online research and examined customer reviews to find out more about real users’ experiences with Xero. Plans start at $15 per month for up to 20 invoices, five bills, bank account reconciliation, receipt capture and short-term cash flow snapshots. Its $78-per-month plan also includes multiple currencies, project tracking, in-depth analytics and employee expense claims. Xero’s pricing structure is an excellent fit for growing businesses.

For self-guided education and troubleshooting, Xero offers support articles in Xero Central. If you have additional questions, click the “Contact Xero support” button at the bottom of any support what is a force pay debit memo article and Xero will contact you by email. Through the sales orders tool within Inventory Plus, you can fulfill orders — you’ll start by entering an item’s weight and package dimensions.

Instead, you must create a support ticket to receive Xero assistance. With them, you can monitor profitability, prepare for future expenses and analyze your business’s growth potential. Xero gives access to custom, ready-to-use, exportable financial reports when you need them as well as the educational tools you need to create the reports you want. Plus, you can favorite reports for easy access and view their data as tree maps, pie charts, bar charts and other visual representations. When rating accounting and invoicing software, we use a 47-point rubric that looks at pricing, ease of use, features, customer service, and user reviews. We weigh each section differently to calculate the total star rating.

And if you don’t like how the dashboard looks, you can reorganize panels and hide the ones that aren’t useful. Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe.

Through our testing, we found this tool ideal for correcting errors or reviewing the work of your less experienced accounting staff members. You can recode contacts, accounts or tax rates in one fell swoop, improving the accuracy of your reconciliation. Additional bank reconciliation tools that we liked include bulk reconciling and quick bank rule creation. Both of these features give you the power to further streamline your reconciliation.

While the software is well-organized, it does have a steep learning curve (not as steep as QuickBooks, but it is more difficult to learn than other cloud-based options). It takes quite a while to explore all of the features it has to offer, but once you get acquainted cost of goods sold journal entry cogs with the software, Xero is fairly easy to use. Getting started is the most difficult part, and it’s this learning curve that lowered our ease of use rating to 3.8/5. One of the advantages of using Xero is that it can save businesses time and money.

While Xero has a lot going for it, pricing increases, a lack of built-in payroll, and limited features on its least expensive plans are potential issues. Additionally, customer support has gone downhill since our last review. Still, despite the price ruling out the software for some small businesses, Xero has a lot to offer for medium and large businesses or those in need of multiple users. Where Sage excels is its lack of limits on clients and invoices.

There’s also a separate time-tracking software—Sage Timeslips—and even a customer management tool called Sage CRM. While it might be nice to have all of these in one dedicated software, it’s nice you can pick and choose exactly which components would best benefit your business. In contrast to allowing unlimited how to calculate retained earnings formula and retained earnings statement users, Xero does limit you to one organization or business per subscription. In other words, if you need to do accounting for more than one business, you’ll need to purchase an account for each one. This is a real drawback for owners of multiple businesses or bookkeepers who work with multiple clients.

Xero is our pick for the best accounting software for growing companies. Because its pricing plans are not based on employee numbers, Xero can easily accommodate various development stages and the changing small business accounting needs accompanying business growth. We recommend Xero for companies that are rapidly adding employees and don’t want to worry about the number of people at the organization using the product. When you sign up for the Growing or Established plans you can add on Inventory Plus — Xero’s full-service inventory management system — for an additional $39/month. With Inventory Plus businesses can fulfill up to 1,500 orders per month from multiple sales channels. The Established plan is best for businesses that have been around for a while or companies that do business internationally.

In some cases, we earn commissions when sales are made through our referrals. These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands of hours of research. We are committed to providing trustworthy advice for businesses. Learn more about our full process and see who our partners are here. Xero tries to throw you as many bones as possible by adding a video or help article to the top of every page you open.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Xero’s features and consumer reviews align closely with competitors. To get started using Xero, you can sign up for its 30-day free trial by providing your name, email address, phone number, and location.

Has robust reporting tools and report customization options, basic inventory tracking in all plans and a capable mobile app; Early plan limits the number of invoices and bills. It allows three users for its Essentials plan ($55 per month) and 25 users for its top plan, the Advanced ($200 per month). This can be helpful if your company is growing fast, or you simply want the reassurance that there’s no limit to how many people can be part of the team. I’m a CPA with 20 years experience and specialize in financial systems applications. Xero is fantastic and this App does what it is supposed to do and it does it very well. With my clients and myself, I use this App to enter receipts, reconcile Bank and credit card accounts automatically fed from the bank, and issue invoices to clients.